CCruncher

The Open-Source Project for Portfolio Credit Risk Modeling

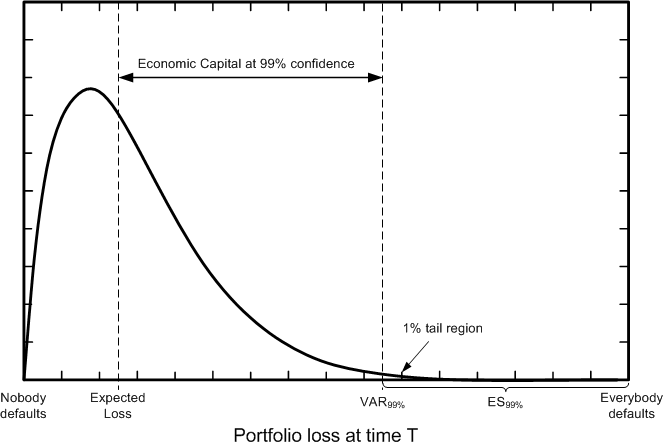

CCruncher-2.6.1 is a project for quantifying portfolio credit risk using the copula approach. CCruncher evaluates the portfolio credit risk by sampling the portfolio loss distribution and computing the Expected Loss (EL), Value at Risk (VaR) and Expected Shortfall (ES) statistics. The portfolio losses are obtained simulating the default times of obligors and simulating the EADs and LGDs of their assets. The solution consists of three components:

Keywords: portfolio credit risk modeling, copula approach, ratings, Probability of Default (PD), transition matrix, Exposure At Default (EAD), Loss Given Default (LGD), industrial sectors, sectorial correlation, multi-factor model, Gaussian copula, t-Student copula, Monte Carlo, MCMC, Expected Loss (EL), Value at Risk (VaR), Expected Shortfall (ES), risk sensitivity, portfolio optimization, open-source.